Silver Gold Bull’s gold IRA products has quite a few constructive characteristics. There is not any bare minimum invest in requirement or account least, and What's more, it prices an affordable gold bar spread. The business also provides respectable customer support.

On top of that, heaven forbid that situation get as grim as existed from the Weimar Republic throughout the 1930’s, but in instances of economic turmoil precious metals certainly are a universally approved forex, whereas the dollar, or other paper assets might only be well worth the paper their printed on.

Although not all gold investments qualify, or are acceptable, to incorporate in an IRA; Permit’s examine which varieties of gold investment makes the Slice!

These firms specialise in encouraging you open gold IRAs, diversify your portfolio, as well as handle the secure storage of your respective gold. They’re your allies in making certain that your gold investments are not merely safe and also tax-advantaged.

Yet another issue that assisted influence the decision was The point that gold has shown in the course of historical intervals of financial uncertainty that precious metals move in the alternative route.

, we offer impartial, neutral critiques of investment companies while in the precious metals and alternative asset Room. Whilst we’ll detail our specific scores requirements later on, viewers must Be aware that we Examine companies as pretty as is possible on the subsequent grounds:

One more tremendous advantage of a Gold backed IRA is the opportunity to change principal and cash in on investments over a tax-cost-free basis. Every time a raging bull industry runs outside of fuel and starts to sputter, physical gold as well as other precious metals rise in price, whilst equities and various investments falter. Traders have the opportunity to capture principal and profit from high priced equity investments and purchase precious metals at cut price prices.

You almost certainly found that many of the companies shown previously mentioned specialize in IRA investing. Also called somebody retirement account (IRA), these investment cars have been released in the nineteen seventies to Permit Us citizens commit for their retirement over a tax-advantaged basis.

Gold IRAs require an impartial trustee or custodian who will deal with and keep physical metals securely inside an authorized depository, which most gold IRA companies supply or do by themselves.

Using your sale proceeds now sitting within an IRA, you might have two decisions with how to proceed with them – either devote them elsewhere or withdraw them fully and become topic to taxes and an early withdrawal penalty of 10%.

Financial advisors ordinarily suggest that five% to 15% of the retirement portfolio be invested in physical precious metals, but an in excess of-valued inventory sector, rising international tensions, and Fed financial insurance policies that have taken the likely income out of a variety of frequent and sites popular investments are very good reasons to contemplate a higher than standard allocation to the precious metals portion.

Just after picking your custodian or gold group, the rollover procedure must start out right away. Typically, this features:

Diversification: Even though gold can provide protection from economic downturns, you can check here buyers ought to diversify their portfolio to attenuate unneeded challenges. Relying entirely on gold places investors at undue possibility.

Noble Gold is comparatively new into the scene but promptly building a name for alone because of its minimal bare minimum investment specifications and exceptional customer service. Perfect for buyers who want to get started tiny, Noble Gold features gold and silver IRAs with several of the least expensive entry points in the market.

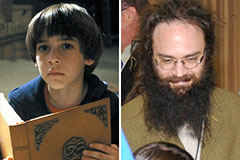

Barret Oliver Then & Now!

Barret Oliver Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!